Archimedes’ Lever:

Forced Appreciation in Commercial Real Estate

Archimedes, the famous Greek mathematician, physicist, engineer, inventor, and astronomer famously stated “Give me a place to stand, and a lever long enough, and I will move the world.” The use and power of leverage when buying real estate is commonly understood and appreciated. Less appreciated, is the role of leverage in forcing the appreciation of real estate which can be equally powerful.

People are familiar with the concept of real estate appreciation as it relates to the increase in value of a single family home, or condominium. This type of appreciation is driven by a combination of housing supply and demand, mortgage interest rates, loan availability, and the local and national economy. None of these contributors to a property’s appreciation can be controlled by the owner of the property. The appreciation is solely influenced by external economic forces.

Appreciation of commercial real estate, however, can be significantly influenced by the property owner, which enables forced appreciation independent of external economic conditions. This ability to force appreciation in commercial real estate is one of the primary levers used by successful real estate investors.

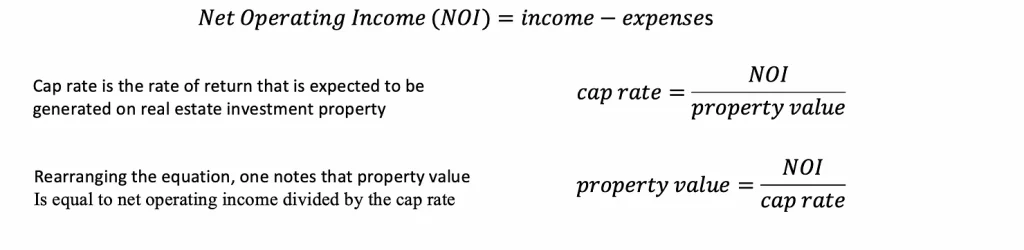

Capitalization Rate

In order to understand forced appreciation, one must first understand the concept of a capitalization rate, or cap rate. The cap rate is used in commercial real estate to indicate the rate of return that one would expect to generate on a real estate investment property independent of financing. At any point in time, across a local market, the cap rate tends to be constant. It is also used to calculate the price of a property as it relates to the properties net operating income. This is the primary difference between the valuation of residential real estate and commercial real estate. Single family home values are determined by the price that similar houses in the area have recently sold for, adjusted for size and condition. Multifamily properties are valued as a multiple of their net operating income, directly calculable from cap rate.

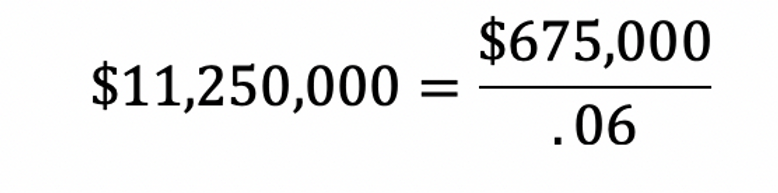

As an example, the 150 unit property mentioned above with $675,000 in net operating income located in a market that features a 6% cap rate has a market value of $11,250,000.

As an example, the 150 unit property mentioned above with $675,000 in net operating income located in a market that features a 6% cap rate has a market value of $11,250,000.

Now that we’ve demonstrated the concept of a cap rate, and how it is used, we will go through two examples that demonstrate the power of forced appreciation in commercial real estate investing.

Forced Appreciation:

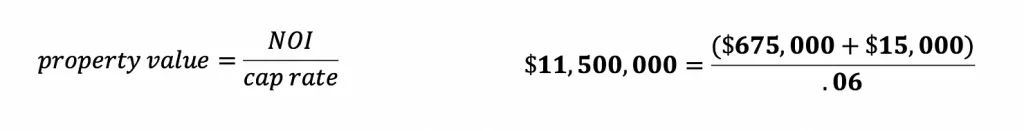

There are two primary ways to force value appreciation, one is to decrease expenses, and the other is to increase income. Both concepts are relatively straight forward so they won’t be elucidated in great detail here. Take a simple example to Illustrate the role that increasing the net operating income has on property value by using a 150 unit property that rents for $750/unit. Assume that the owner decides to allow pets in the apartment building when there were none allowed prior, and charges a $25/month pet fee. If 1/3 rd. of the tenant decide to own pets (50 people), the monthly income of the property increases by $1,250, which is $15,000 per year. While this is a nice increase in the property’s cashflow per year, the real value in this additional amenity comes from the increased property value associated with the increased NOI. This relatively simple change to the property’s operation has resulted in an increased property value of $250,000.

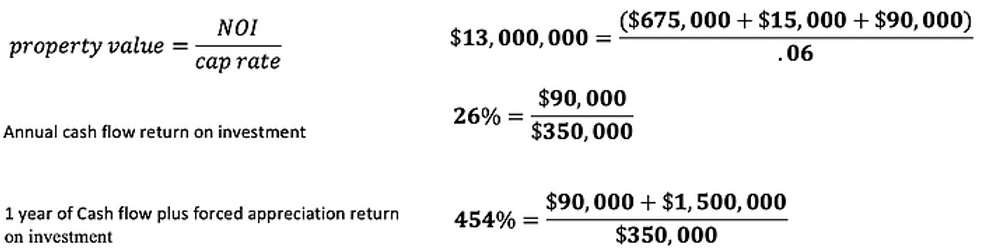

Next, we evaluate the role that forced appreciation plays in executing a unit upgrade plan. In this example, the owner decides to upgrade 1/3rd of the units in the property with new floors, appliances, cabinets, counter tops and fixtures. The cost of this renovation is $7,000/unit, equating to a total cost of $350,000. The upgraded units command a rent premium over the non-upgraded units of $150/month, resulting in a monthly NOI increase of $7,500, and annual NOI increase of $90,000. This NOI increase of $90,000 with the investment of $350,000 results in a 26% annual return on investment. However, when one considers the value of the appreciation that the owner forced due to this renovation, the return on investment is 454%, and results in an increased property value of $1,500,000.

We hope this article has provided the basis for a clear understanding of the concept of forced appreciation, and the outsized role it can play in commercial real estate investing.