Prop-Tech Companies Are Moving to the Public Markets

Prop-Tech companies are moving to the public markets – The most recent: Matterport, a virtual property tour software platform that is merging with SPAC valuing

Prop-Tech companies are moving to the public markets – The most recent: Matterport, a virtual property tour software platform that is merging with SPAC valuing

Multifamily prices rose 156% in 10 years, or an average of 15.6% per year from 2010-2020. The per unit price for multifamily properties has

The multifamily sector’s resilience continues to attract investment from a broad range of investors. Real estate investors are remain optimistic that property values and investment

Proper recently raised $4.8 million to revolutionize the on-demand property accounting space. Proper, is breaking headlines in the prop-tech industry. The company is an AI-powered

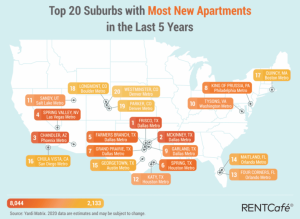

RENTCafe researchers found that suburbs have a “newfound appeal” for renters primarily in the sun belt. Suburban apartments typically offer larger units, lower density, and

Clubhouse is an invite only audio networking platform that allows invited users to listen in on live chats and join industry and sector specific clubs.

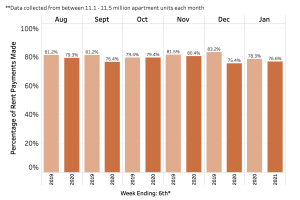

Rental Income for the week ending the 6th remains slightly lower YoY but higher MoM as millions of renters seeks rental relief. In the recently

Agency Lending: Fannie and Freddie are to remain as government sponsored enterprises as the outgoing administration previously considered an 11th hour effort to privatize. Pricing

Redfin analysts remain bullish on the housing industry leading into 2021 as mortgage rates are expected to remain at historic lows, 14.5 million Americans are

2020 has been a year to reflect upon , a year that will change the path forward in the multi family industry permanently, especially

The multifamily sector has remained relatively stable throughout the pandemic. Rent payments continue to remain slightly below 2019 levels but have shown signs of optimism

To become an EM Capital investor you must complete the following process:

Investments range between $25,000 and $10M.

Once you complete the qualification form and upon review, you will begin receiving notification of investment opportunities via email. You will also be able to access our new opportunities page.

You can email us your level of interest and dollar amount. All investments are prioritized on a first come first serve basis.

EM Capital has a dedicated investor platform. This platform enables you to log in and review all of your investments and distributions in one convenient location 24/7. We email detailed quarterly updates outlining the progress of your investment. If you are an existing client you can log in here.

Distributions are sent quarterly upon the first full quarter of ownership.

We will forward this information upon completion of the qualification form.

If you are not a U.S. citizen, but live and work in the U.S., you may be eligible to invest. Our investments are available to investors with a valid EIN#, TIN#, or SSN#. You’ll also need a U.S. bank account as well as a U.S. mailing address. We hope to be accessible to international investors in the future.

You are investing in a Massachusetts LLC that controls the property. All investors are members of the LLC which is controlled by an OA approved by all investors. All investors receive their pro rata share of the depreciation and tax advantages.

The unique use of depreciation and cost segregation to accelerate depreciation capture produces the most favorable income tax treatments of any asset class. Provisions in the Tax Cut and Jobs Act of 2017 effectively shelters all property income (and more) through the life of an investment.*

$5 – $75 Million

Minimum 100 Unit Asset

Class C+ to A- multifamily properties

Prefer class B assets in A locations

Stabilized properties

Minimum 85% occupancy

Preference is 1978 and newer but will consider all properties.

U.S. employment and population growth markets.

A+ and B+ trade areas with strong demographics and economic diversity.

Varies based on value add potential.

13%-16% investor Internal Rate of Return (IRR). 16%-20% investor Return on Investment (ROI).

8%-10% average Cash on Cash returns over the hold period.

3 to 10 year hold periods.

Value add opportunities (physical and operational).

High yield income streams.

Below replacement cost assets.

Cash equity ––“All cash” or “Cash to existing debt”.

Utilities – Prefer individual metered units – but not required.

Roofs – Prefer pitched roof construction – but not required.

Premier Properties – Prefer properties with minimal deferred maintenance – but will consider others if well located and possessing a strong value add upside opportunity.

529 Columbus Ave (#18)

Boston, MA 02118

We use cookies to make the website work well for you.

By continuing to surf, you agree to that we use cookies.What are cookies?