Pursuing Alternative Financing for New Investments

To invest in real estate, you must understand how to get creative with your financing – especially under current circumstances. Today, many investors are unable

To invest in real estate, you must understand how to get creative with your financing – especially under current circumstances. Today, many investors are unable

Your Multifamily Lending Update by EM CAPTIAL LLC. Nearly 91% of 11.4 million apartment households surveyed across the country made a full or partial rent

Augmented and Virtual Reality is here to stay. Researching and visiting new places to live or invest in has quickly become a lengthy and

Your Multifamily Lending Update by EM CAPTIAL LLC. 87.7% of apartment households made a full or partial rent payment. GSE: Fannie/Freddie: The index

The Software as a Service, SaaS boom is exploding in the real estate industry resulting in new property management platforms and new innovative property

Archimedes’ Lever: Forced Appreciation in Commercial Real Estate Archimedes, the famous Greek mathematician, physicist, engineer, inventor, and astronomer famously stated “Give me a place

Your Multifamily Lending Update by EM CAPTIAL LLC. As previously mentioned noted, RealPage had forecasted more than 366,000 units to come this year. In Q1

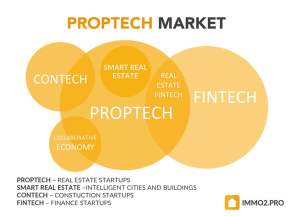

Introducing a new series by EM Capital – Multifamily Real Estate in the Digital Age. Issue 1 – Introduction to “Proptech” The Proptech

Your Multifamily Lending Update by EM CAPTIAL LLC. Multifamily Market: Class C properties are the winner for growth in new lease signings. They are up

1. Hire a high-quality property manager If you do not personally manage your property, hire the right manager. Always interview multiple managers and speak with

Your Multifamily Lending Update by EM CAPTIAL LLC. Fannie: Fannie Mae’s Underwriting Standards floor has stayed at 90 basis points for the 10, 12,

Renters are still hunting for new places to live amid the crisis. After seeing positive April rent numbers and more states opening for business, residential

To become an EM Capital investor you must complete the following process:

Investments range between $25,000 and $10M.

Once you complete the qualification form and upon review, you will begin receiving notification of investment opportunities via email. You will also be able to access our new opportunities page.

You can email us your level of interest and dollar amount. All investments are prioritized on a first come first serve basis.

EM Capital has a dedicated investor platform. This platform enables you to log in and review all of your investments and distributions in one convenient location 24/7. We email detailed quarterly updates outlining the progress of your investment. If you are an existing client you can log in here.

Distributions are sent quarterly upon the first full quarter of ownership.

We will forward this information upon completion of the qualification form.

If you are not a U.S. citizen, but live and work in the U.S., you may be eligible to invest. Our investments are available to investors with a valid EIN#, TIN#, or SSN#. You’ll also need a U.S. bank account as well as a U.S. mailing address. We hope to be accessible to international investors in the future.

You are investing in a Massachusetts LLC that controls the property. All investors are members of the LLC which is controlled by an OA approved by all investors. All investors receive their pro rata share of the depreciation and tax advantages.

The unique use of depreciation and cost segregation to accelerate depreciation capture produces the most favorable income tax treatments of any asset class. Provisions in the Tax Cut and Jobs Act of 2017 effectively shelters all property income (and more) through the life of an investment.*

$5 – $75 Million

Minimum 100 Unit Asset

Class C+ to A- multifamily properties

Prefer class B assets in A locations

Stabilized properties

Minimum 85% occupancy

Preference is 1978 and newer but will consider all properties.

U.S. employment and population growth markets.

A+ and B+ trade areas with strong demographics and economic diversity.

Varies based on value add potential.

13%-16% investor Internal Rate of Return (IRR). 16%-20% investor Return on Investment (ROI).

8%-10% average Cash on Cash returns over the hold period.

3 to 10 year hold periods.

Value add opportunities (physical and operational).

High yield income streams.

Below replacement cost assets.

Cash equity ––“All cash” or “Cash to existing debt”.

Utilities – Prefer individual metered units – but not required.

Roofs – Prefer pitched roof construction – but not required.

Premier Properties – Prefer properties with minimal deferred maintenance – but will consider others if well located and possessing a strong value add upside opportunity.

529 Columbus Ave (#18)

Boston, MA 02118

We use cookies to make the website work well for you.

By continuing to surf, you agree to that we use cookies.What are cookies?